If you’re looking for a credit card that can help you build or rebuild your credit, the MyMilestoneCard might be just what you need. It’s a product of the Bank of Missouri, in partnership with Genesis FS Card Services. This card is specifically designed for individuals who may not have the best credit history but are eager to improve their credit score. Let’s dive into what makes the MyMilestoneCard unique, its benefits, drawbacks, and how it can help you on your financial journey.

The MyMilestoneCard is a MasterCard credit card aimed at helping individuals with less-than-perfect credit histories. It provides a chance to build or rebuild credit by reporting to the three major credit bureaus: Experian, Equifax, and TransUnion. This feature can be particularly beneficial if you’re trying to improve your credit score over time.

Key Features of MyMilestoneCard

- Credit Building: The card reports to all three major credit bureaus, allowing you to build a positive credit history with responsible use.

- Pre-Qualification: You can check if you pre-qualify for the card without affecting your credit score. This is a soft inquiry and won’t impact your credit rating.

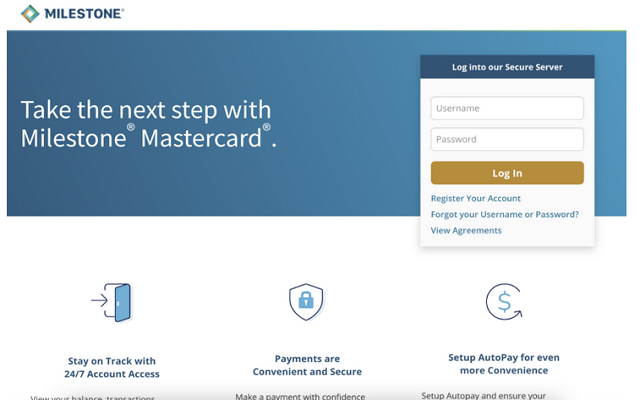

- Online Account Management: Manage your account online, make payments, and view transactions with ease.

- Fraud Protection: Offers protection against unauthorized purchases, giving you peace of mind.

- MasterCard Acceptance: Use your MyMilestoneCard anywhere MasterCard is accepted, which includes millions of locations worldwide.

- Mobile Access: Access your account on the go with the mobile-friendly website.

- Customer Service: Dedicated customer service to help you with any issues or questions you might have.

- No Security Deposit: Unlike secured credit cards, the MyMilestoneCard does not require a security deposit.

- Customizable Card Design: Choose from a variety of card designs to personalize your card.

- Regular Credit Line Reviews: Potential for credit line increases based on your payment history and creditworthiness.

Benefits of MyMilestoneCard

1. Credit Reporting

The most significant advantage of the MyMilestoneCard is its credit reporting feature. By reporting to all three major credit bureaus, it helps you build a positive credit history. This can lead to an improved credit score, which is crucial for future financial endeavors.

2. Pre-Qualification Process

The pre-qualification process is straightforward and does not affect your credit score. This means you can see if you’re likely to be approved for the card without any negative impact on your credit.

3. No Security Deposit

Unlike many other credit cards designed for individuals with poor credit, the MyMilestoneCard does not require a security deposit. This makes it more accessible for those who may not have the extra funds for a deposit.

Drawbacks of MyMilestoneCard

While the MyMilestoneCard offers several benefits, it’s essential to be aware of its drawbacks:

1. High Fees

The MyMilestoneCard comes with various fees, including an annual fee, which can be quite high compared to other credit cards. Make sure to read the terms and conditions carefully to understand all the associated costs.

2. High APR

The interest rates on the MyMilestoneCard can be relatively high, which means carrying a balance can become expensive. It’s advisable to pay off your balance in full each month to avoid high-interest charges.

3. Limited Rewards

The MyMilestoneCard does not offer a rewards program, which means you won’t earn points or cash back on your purchases. If rewards are important to you, you might want to consider other options.

Applying for MyMilestoneCard

1. Pre-Qualification

Start by visiting the MyMilestoneCard website and completing the pre-qualification form. This step does not affect your credit score and gives you an idea of your approval chances.

2. Application Process

If you pre-qualify, you can proceed with the full application. You’ll need to provide personal information, including your name, address, Social Security number, and income details.

3. Approval

Once you submit your application, you’ll typically receive a decision within a few days. If approved, your new card will be mailed to you, and you can start using it to build your credit.

Managing Your MyMilestoneCard

1. Online Account Management

The MyMilestoneCard offers a user-friendly online account management system. You can log in to view your balance, make payments, and track your spending. This feature makes it easy to stay on top of your finances.

2. Payment Options

You can make payments online, by phone, or by mail. Setting up automatic payments can help ensure you never miss a due date, which is essential for maintaining a good credit score.

3. Monitoring Your Credit

Regularly monitor your credit score and report to see how your MyMilestoneCard usage is impacting your credit. Many free services can help you track your progress.

Tips for Using MyMilestoneCard Effectively

Always make your payments on time. Late payments can negatively impact your credit score and result in additional fees. Try to keep your credit utilization ratio below 30%. This means if your credit limit is $1,000, you should aim to keep your balance below $300. Regularly check your statements for any unauthorized charges or errors. Reporting these promptly can help protect your account.

The MyMilestoneCard can be an excellent tool for building or rebuilding credit. However, it’s essential to weigh the benefits against the potential drawbacks. If you can manage the fees and high-interest rates, this card can help you improve your credit score and achieve your financial goals.

Conclusion

In summary, the MyMilestoneCard is a viable option for those looking to build or rebuild their credit. It offers valuable features like credit reporting, a pre-qualification process, and no security deposit requirement. However, it’s important to be mindful of the fees and interest rates associated with the card. By using the MyMilestoneCard responsibly, you can take significant steps towards improving your credit score. Start your journey today and take control of your financial future.